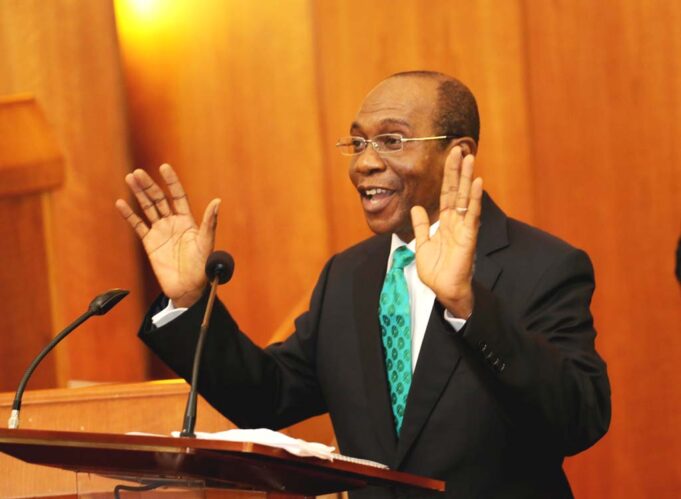

The Senate, on Wednesday, resolved to invite the Governor of the Central Bank of Nigeria, Godwin Emefiele, to educate and inform senators in a closed session on the reasons for the rapid depreciation of the value of the naira.

It also mandated the Senate Committee on Banking, Insurance, and Other Financial Institutions to assess the impact of CBN intervention funds meant to support critical sectors of the economy.

The resolutions were reached by the lawmakers after the upper chamber of the National Assembly considered a motion sponsored by Sen.Olubunmi Adetunmbi (APC-Ekiti).

The motion was entitled, ‘State of CBN Intervention Funds and Free Fall of Naira’.

Rising under Orders 41 and 51 of the Senate Standing Order, as amended, Adetunmbi decried Nigeria’s economic reality amid an urgent call for “extraordinary measures”.

He said the CBN, through its numerous multi-sectoral intervention funds, provided special funds to support critical sectors of the economy.

The lawmaker stated that in view of such interventions, it had become necessary to assess the state of implementation and effectiveness of the funds deployed for the purpose.

Adetumbi recalled that the CBN, in 2021, placed an indefinite halt on forex bidding by Bureau de Change operators (BDCS) and importers over allegations of abuse and mismanagement, adding that the halt by the apex bank resulted in a spike of the exchange rate.

According to Adetunmbi, the two instruments of Personal Travel Allowance (PTA) and Business Travel Allowance (BTA) could only serve less than 20 per cent of the total forex demand by travelers and businesses.

The senator further expressed worry that the import and export window meant to serve the forex needs of business giants has become “a rare opportunity that only a privileged few can access”.

READ ALSO: Naira crashes to N710/$1

“These and a number of others have contributed to the excessive scarcity of forex in Nigeria today,” he added.

Adetumbi noted that as of July 26, the exchange rate in the autonomous segment (BDCS) of the foreign exchange market is N670 to one U.S. Dollar and projected to end at N1000 by end of the year, based on the current rate of depreciation.

The senator, however, enjoined CBN to take new measures to curb forex scarcity and address the sliding rate of naira exchange.

In his contribution, Sen. Sani Musa (APC–Niger) faulted the Central Bank’s decision to halt foreign exchange biddings, thereby cutting off the parallel market – Bureau de Change operators.

According to him, the attempt by the CBN to control the value of the naira with the continuous exclusion of BDCs would only lead to its further depreciation.

He, therefore, advised the apex bank to rather ensure the regulation and monitoring of the parallel market.

“What CBN used to do was to give out 10,000 dollars to each of these BDCs with a clear directive for it not to be sold above N470 as against the 419 dollars exchange rate.

READ ALSO: Naira gains against dollar at Investors, Exporters’ window

“But today, nobody is determining where the rate is going and I can assure you we can’t have that solution because we are only importing,” he said.

On his part, Sen. Ahmad Babba-Kaita, said the only way to improve the value of the naira was to encourage foreign investments to attract an inflow of other currencies into Nigeria.

“The only way we can access the dollar will be determined by other economies and not ours,” Babba-Kaita said.

He, however, attributed the lack of foreign investments in Nigeria to the poor security situation caused by banditry, terrorism, and other criminal activities.

The Senate, in its resolutions, called on the CBN to urgently intervene to stop the rapid decline in the value of the naira vis-à-vis the dollar, and other international currencies.

It also mandated the Senate Committee on Banking, Insurance and Other Financial Institutions to conduct an assessment of CBN intervention funds and the declining value of naira to come up with sustainable solutions

- OrderPaper founder, Oke Epia, appointed to global parliamentary group - December 20, 2024

- Army promotes 108 officers - December 20, 2024

- EPL fixtures: Aston Villa host Man City as Liverpool face Tottenham - December 20, 2024