Some experts have decried the inefficiencies and lack of governance in the banking sector, urging the Central Bank of Nigeria (CBN) to regulate and supervise the banks for improvement.

The experts involving panellists and contributors at the online citizen-organised People’s Parliament said without urgent CBN intervention and another major restructuring in the industry, the banks will continue to devise ways to maximise profit to the detriment of Nigerians hurt by the banks.

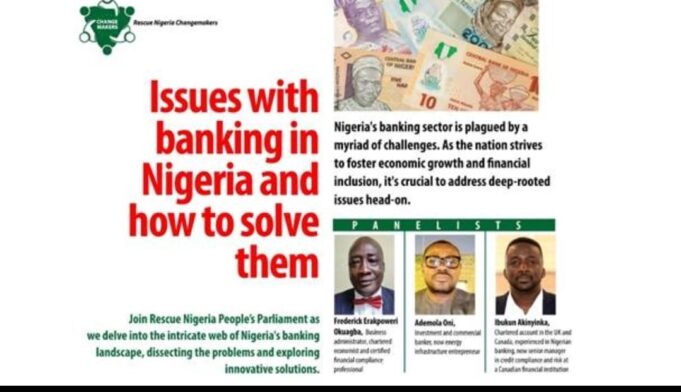

The People’s Parliament has been organised for more than two years by the Initiative for Good and Informed Citizenship, a civil advocacy group popularly known as Rescue Nigeria, formed to educate and empower Nigerians about social and political issues.

Panellists at the event held recently included Frederick Okuagba, a business administrator, chartered economist and certified financial compliance professional; Ademola Oni, investment and commercial banker, now energy infrastructure entrepreneur; and Ibukun Akinyinka, a chartered accountant in the United Kingdom and Canada, experienced in Nigerian and Canadian banking.

Former banker Oni expressed concerns about the current state of the banking sector, highlighting issues such as lack of regulation, irresponsible marketing, and a focus on consolidation over expansion.

He stated that regulatory bodies need to be more proactive in monitoring and regulating banks, and suggested that aggressive marketing tactics should be reined in.

“Things were going well with the banks until the change of guard at the CBN to a former banker and shareholder of a bank. They have amended so many regulations that had been in place, to suit themselves,” Oni said.

Forex: CBN sells $122.671m to 46 dealers

Also speaking, Akinyinka said while there was an urgent need for strict banking regulations in Nigeria, the banks also operate in a difficult environment, adding that the time is right for another consolidation in the industry.

“The banks are relaxed and are not competitive in terms of delivering service. They just want to make profit. We need a revolution in the banking industry. When you have to line up to enter a bank, you are going to have issues. The banks need to invest in infrastructure, technology and training,” the accountant stated.

The Canadian banker further discussed the evolution and challenges of the banking industry in Nigeria, particularly focusing on the impact of off-site ATMs and Fintech services.

He highlighted how banks previously made profits from off-site ATMs, noting that regulatory changes and the introduction of Fintech services disrupted the revenue stream.

Akinyinka, however, stated that Fintechs have opened up new opportunities in service delivery.

Akinyinka added that microfinance banks, closer to the SME market, were also stifled by the operating environment.

“No business can make be successful if the lending rate is at 30 per cent, and banks find it difficult to lend at lower rates because of the risk of default,” he said.

On his part, Okuagba said most of the profits declared by the banks were paper profits and called for a more honest approach to policy and guideline implementation.

Okuagba and other experts further enjoined banks to build capacity to address customer complaints, increase staffing requirements for online transactions, and implement measures to prevent tampering with ATMs.

- CBN warns Nigerians against fraudulent contractors - November 18, 2024

- Presidency: Obasanjo abused office to advance personal interest - November 18, 2024

- Arsenal consider PSG’s Campos to replace Edu - November 18, 2024