The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) has retained the country’s Monetary Policy Rate (MPR) at 11.5 per cent for the umpteenth time.

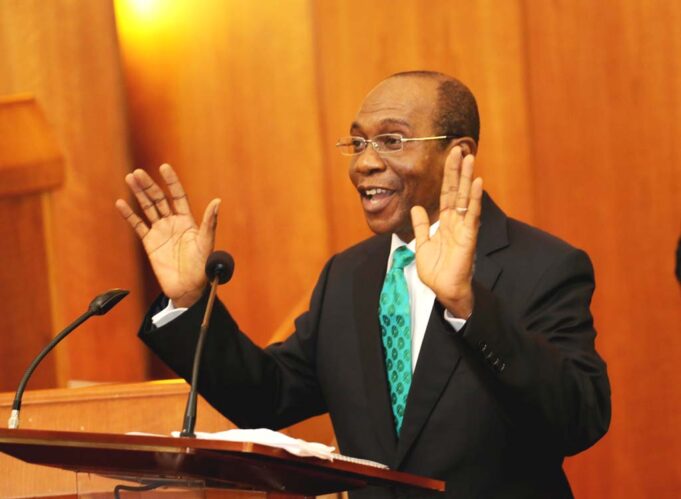

CBN Governor, Mr. Godwin Emefiele, the who announced this on Monday in Abuja while reading a communique from the apex bank’s second MPC meeting for 2022, said that the committee also decided to hold all other parameters constant.

The Assymetric Corridor of +100 -700 basis points around the MPR was retained, Cash Reserve Ratio (CRR) retained at 27.5 per cent and the Liquidity Ratio retained at 30 per cent.

Emefiele said that the 10 members of the committee at the meeting were divided on policy decisions.

“Three members voted to raise MPR by 25 basis points, one member voted to raise MPR by 50 basis points while six members voted to hold all parameters constant,” he said.

According to Emefiele, the MPC was of the view that increasing the rates during inflation could adversely impact on economic recovery and stifle expected investment expansion.

“Tightening would reverse the steady improvement recorded in credit expansion, and it will not necessarily tame inflation.

“On the other hand, loosening will trigger further liquidity challenge and also trigger foreign exchange demand pressure as the excess liquidity would exert demand pressure on the foreign exchange market,” he said.

He added that the committee decided to adopt a policy stance that indicates a precautionary and consistent policy stance with the prevailing economic conditions.

- Bishop Odedeji: Jesus birth, most remarkable event in human history - December 25, 2024

- Zenith Bank, Int’l Breweries, NNPC, Others Shine at 2024 SERAS Awards - December 24, 2024

- Uba Sani inaugurates 12 road projects on Xmas Eve - December 24, 2024